|

Notable Contracts*

- City of Tulsa, OK – Enterprise ERP

- City of Albuquerque, NM – Enterprise Permitting & Licensing

- Mecklenburg County, NC – Records Management

- Virginia State Police – Enforcement Mobile

- City of Grover Beach, CA – ERP Pro

- Adams 12 Five Star Schools, CO – Student Transportation

Iowa Department for the Blind selects Tyler’s solution.

Read more.

Tyler announces its

Q4 2022 earnings.

Read more.

Tyler named to America’s Greatest Workplaces for Diversity list.

Read more.

DFW Airport goes live with Tyler’s permitting solution.

Read more.

Kansas to improve transparency with Tyler’s data & insights solution.

Read more.

Delray Beach, FL, strengths resident communication with Tyler’s application.

Read more.

*The above list shows a selection, not a comprehensive list, of Tyler’s recent contract signings to demonstrate the variety of Tyler’s solutions.

|

With articles focusing on our digital applications, public safety, and student transportation solutions, Tyler began the year securing coverage that put a spotlight on several of our clients’ successes. Below is a brief roundup of ‘Tyler in the News’ over the past two months:

- GCN covered West Virginia’s success as the first state in the nation to digitize its vehicle titling process with help from Tyler’s solution. Before the technology was implemented, it took the West Virginia DMV up to 40 days for a vehicle title application to be approved. Now, that process takes just four days. Governor Jim Justice said the digitized effort is “more secure, much faster, good for the environment, and it puts our citizens first.”

- A GovTech article discussed the Law Enforcement Assisted Diversion (LEAD) program in Cheyenne, Wyoming, which connects people with substance use disorders with healthcare workers so police don’t have to continue to arrest the same subjects over and over. By using Tyler’s public safety suite, local police and sheriff agencies can share critical information to enable LEAD to get the best help to their constituents.

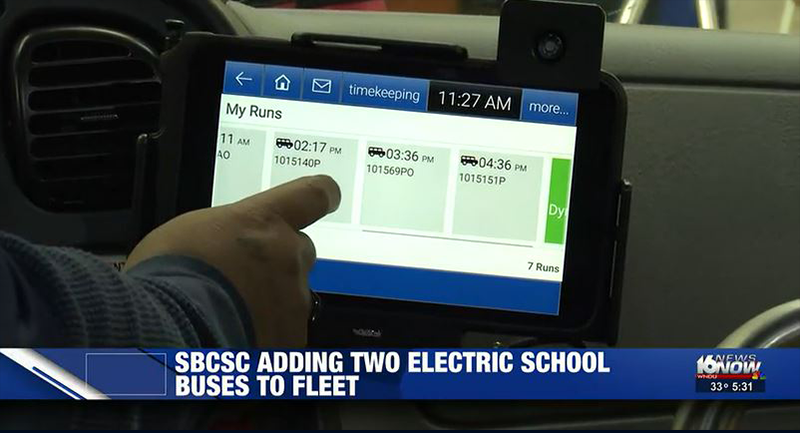

- A WNDU-TV broadcast in South Bend, Indiana, highlighted the school district’s recent advancements, including the addition of two zero emission electric schools buses and Tyler Drive tablets. Each school bus in the district is now equipped with a tablet, which lets the district track which students get on the bus, which route each bus is on, and it also helps drivers know the best possible routes to take to transport kids to and from school.

Tyler CFO Brian Miller comments on Tyler’s Q4 earnings and outlook for 2023.

As we closed the fourth quarter and look forward to 2023, we are pleased to see public sector demand remain strong and SaaS adoption continue to accelerate. The fourth quarter was marked by two major trends. The first was the increase of subscription arrangements for new client engagements and steady on-premises migration to cloud deployments. The second trend was increased deal activity related to Tyler’s payments solutions.

In 2022 we made meaningful progress in our cloud journey through continued investment in cloud optimization and through a move to cloud-only deployment for many of our core solutions. In Q4 alone, software subscription arrangements comprised approximately 83% of total new software contract value, compared to approximately 71% in 2021. During the quarter, we signed several multi-suite SaaS deals with total contract value greater than $2 million in addition to a number of mid-size deals in the $1 million - $2 million range. In addition, we are seeing increased client “flips” of on-premises deployments to the cloud; we saw an increase of about 40% year-over-year on these flips. While our client base is transitioning to the cloud at different rates depending on their chosen applications, we expect approximately 90% of our new contract mix in 2023 will be SaaS deployments.

We are also very encouraged by the success of our payments business in 2022, signing 571 new payments deals, which we expect will add $13 million in annual recurring revenue. Internally, we have integrated our payments teams and launched a significant go-to-market strategy for payments. We believe that our growth rate for payments will continue to accelerate in 2023, both through cross-sell and upsell opportunities and as a result of the expanded payments capabilities that the Rapid Financial Solutions acquisition brings through its robust disbursements technology.

|